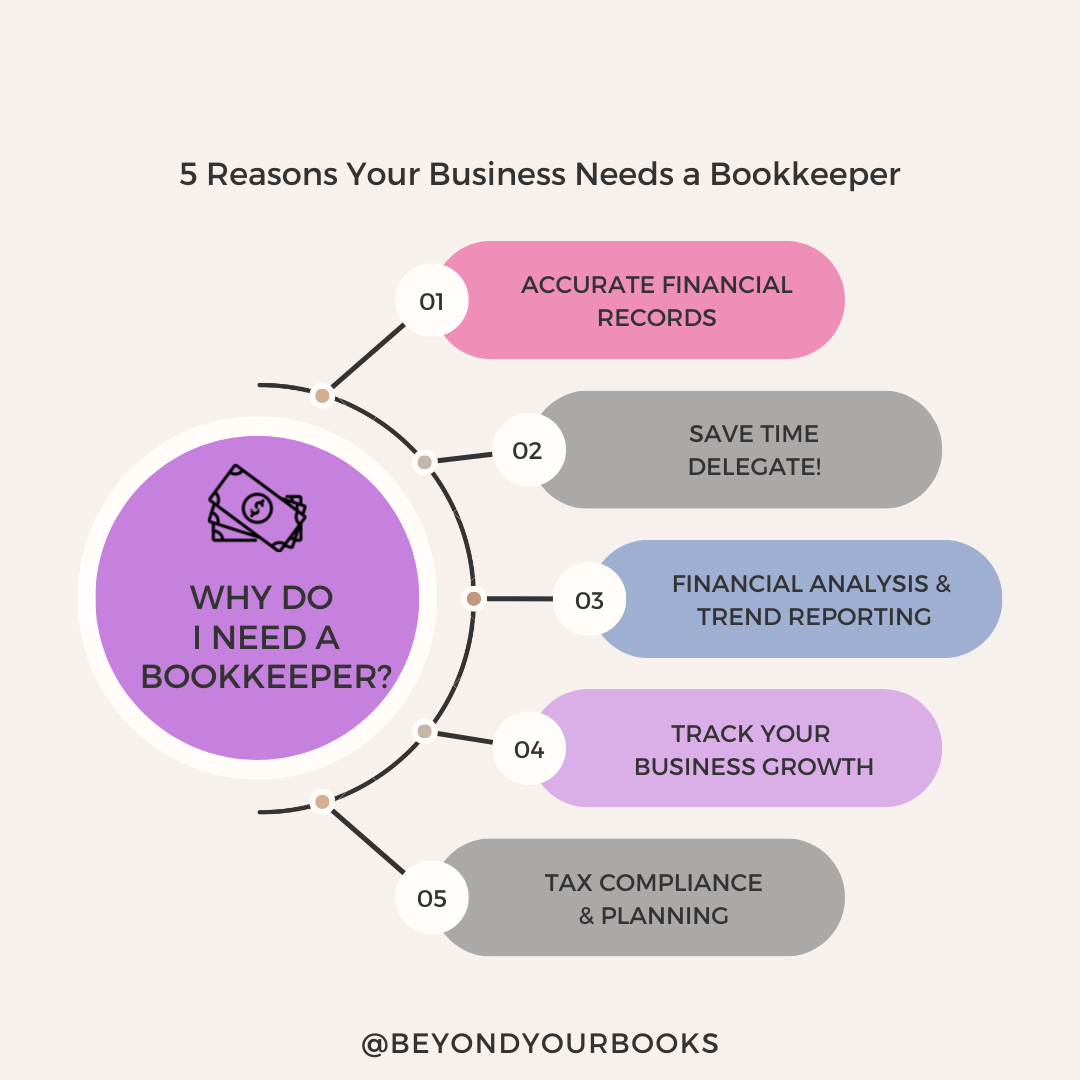

Why do I need a bookkeeper?

Here are 5 simple reasons your business needs a bookkeeper.

Accurate Financial Records: Our Extraordinary Bookkeepers are trained to maintain accurate and up-to-date financial records. We track financial transactions such as income, expenses, invoices, receipts, payroll, taxes and other metrics, ensuring your financial data is organized and reliable. Our attention to detail can prevent errors and ensure compliance with financial regulations. Beyond Your Books Bookkeepers are trained professionals with knowledge of accounting principles and financial best practices. We are a Mastery-Level Certified Profit First Firm, which enhances our mission to help entrepreneurs succeed by eliminating cash flow struggles, scarcity and fear-based tendencies.

Save Time: Bookkeeping can be time-consuming, especially if you're not familiar with accounting principles. Hiring Beyond Your Books allows you to focus on core business activities, saving you time and energy. It’s time to Delegate! As a full-service bookkeeping firm, Beyond Your Books can simplify the management aspect of your business with streamlining your bookkeeping, payroll, tax recording keeping, reconciling accounts receivables and payables. Our systems, processes and preferred software have been vetted to spend our time effectively on your accounts. Spend your time in the CEO role – not on tasks that should be delegated to our Extraordinary Bookkeepers.

Financial Analysis & Trend Reporting: Our Extraordinary Bookkeepers can provide valuable financial insights by preparing reports, budgets, and financial statements. These analyses help you make informed decisions and identify areas for improvement. Our team, including Certified Profit First Professionals, can help identify unnecessary expenses through an expense audit, track cost trends, and find ways to reduce costs, contributing to improved profitability. Becoming more profitable happens one of two ways: increasing revenue or reducing expenses, or both!

Track Your Business Growth: With accurate financial records, you can better understand your business's financial health, identify profitable areas, and plan for growth more effectively. Bookkeepers can work with you to create a financial forecast and plan that aligns with your business goals, helping you achieve long-term success. As a Profit First Firm, we use this system of cash-flow accounting to help our clients scale. The Profit First system creates intention behind your day-to-day cash flow management. Improve your Cash Flow with Implementation of the Profit First method (video demo).

Tax Compliance: Bookkeepers help ensure you meet your tax obligations. They keep track of deductible expenses, prepare financial statements for tax purposes, and can assist during tax preparation. Avoiding Penalties from late or incorrect tax filings, especially those that are often state specific. A bookkeeper can help you stay on top of deadlines and ensure your records are accurate, reducing the risk of penalties.